What IRS Budget Cuts Mean for Small Business Taxpayers

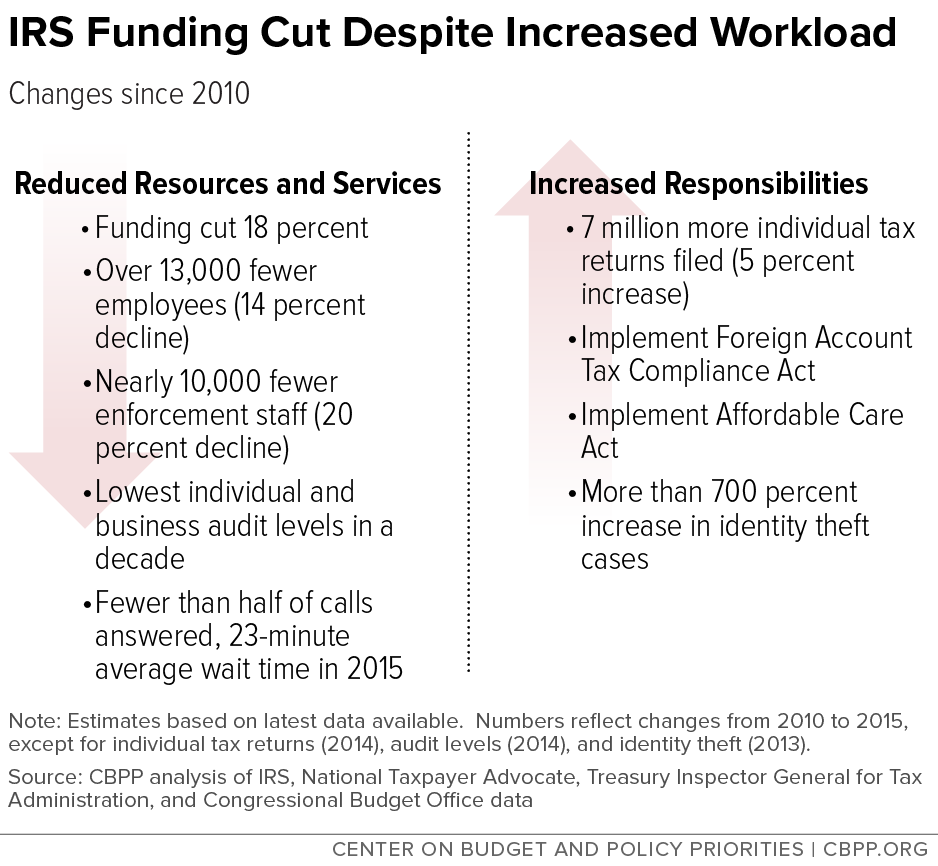

Policymakers have continued to cut the budget of the IRS despite repeated warnings from sources like the IRS Commissioner, National Taxpayer Advocate, Treasury Inspector General for Tax Administration. At this point, the ability of the IRS to carry out its mission has been severely diluted, and US taxpayers are feeling the results.

What IRS Budget Cuts Mean for Small Business Taxpayers Read More »