With Sturdy Transition Plan in Place, Stacey J. Gorowitz Announces Retirement from Namesake Firm

As the founding Principal and CEO of S.J. Gorowitz Accounting & Tax Services, Stacey J. Gorowitz, CPA, has spent more than 30 years supporting the

Your financial statements should show a complete picture of your business, and lay the foundation to help you create a strategy for the future.

READ MORE>

Tax returns prepared to ensure we minimize your liability and keep more of your earnings over the long term.

READ MORE>

From proper entity selection at the inception of a business to developing an exit strategy, we are here to guide you in making informed decisions that are goal driven and take into consideration the materiality of your financial situation.

READ MORE>

We maximize your QuickBooks investment by customizing the software to meet your specific needs and industry best practices.

READ MORE>

We employ strong analytical and communication skills to produce evidence that supports your position in cases of a dispute or negotiation.

READ MORE>

Whether you are selling, acquiring or expanding, we are well equipped to ensure you respond to opportunities swiftly and with confidence.

READ MORE>

Ensuring you are in compliance with tax reporting and filing requirements provides peace of mind.

READ MORE>

Success in manufacturing and distribution hinges on your ability to manage numerous details with accuracy and foresight into how they impact current and future operations.

READ MORE>

You focus on your core competencies, customer service and strategy and we’ll keep you from getting caught off-guard by daily financial tasks or overwhelmed by growth.

READ MORE>

Patient care is your primary concern. Providing the best clinical experience for your patients continues to get more difficult and costly. Delivery models are changing from fee for service to quality based.

READ MORE>

Running a legal firm is a balancing act with high stakes. Your reputation hinges on your ability to support clients with responsiveness and accuracy.

READ MORE>

Real estate is characterized by large material gains and losses. Every transaction has the potential to impact your accounting and tax situation.

READ MORE>

Perhaps more than any other industry, technology companies must have an infrastructure built to scale. A culture of continuous iteration requires an ability to account for a fluctuating profit margin.

READ MORE>

With a consultative, integrated approach to accounting, tax and consulting services for businesses and individuals, we work hand in hand with you to achieve your goals.

READ MORE>

Renewable energy is an area of growing interest for businesses, as well as the advantageous tax incentives when transitioning operations to include new energy solutions. Read our series of articles to LEARN MORE.

As the founding Principal and CEO of S.J. Gorowitz Accounting & Tax Services, Stacey J. Gorowitz, CPA, has spent more than 30 years supporting the

Think back over the past year. Were you surprised by a large 2014 tax bill or items you didn’t expect to see? Chances are, if you’re the

The complexity of Medicare and the myriad options enrollees face can be daunting. Here are some pointers on how to go about enrolling for Medicare,

As we approach the end of 2014, many small businesses are looking eagerly at the potential in 2015. Knowing how to close out the year at

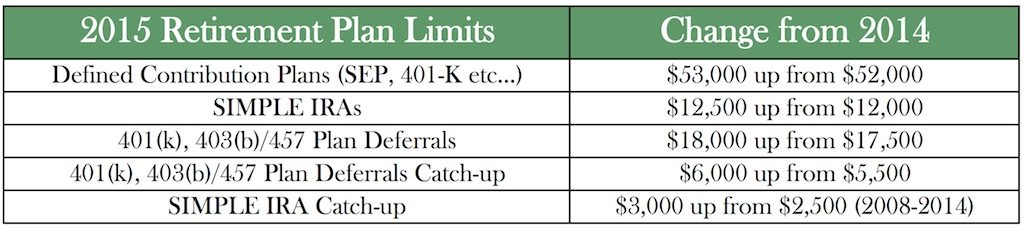

Between 2013 and 2014, business owners and wage-earning employees saw almost no increases in allowable contribution and elective deferral limitations. Tax year 2014 was characterized

By Stacey Gorowitz, CPA, MBA If you’re like most people, you’re heaving a sigh of relief this week and feeling like a huge weight has come

SIGN UP FOR OUR NEWSLETTER

By submitting this form, I understand I may periodically receive informational emails from S.J. Gorowitz Accounting & Tax Services

S.J. Gorowitz Accounting & Tax Services supports expanding and emerging businesses and their owners with a consultative, inclusive approach. Clients turn to us to maintain accurate financials, minimize taxes and ensure compliance, so they can meet financial and business goals now and into the future.

The highest compliment is the trust you exhibit when recommending me to others who may benefit from the services we provide.