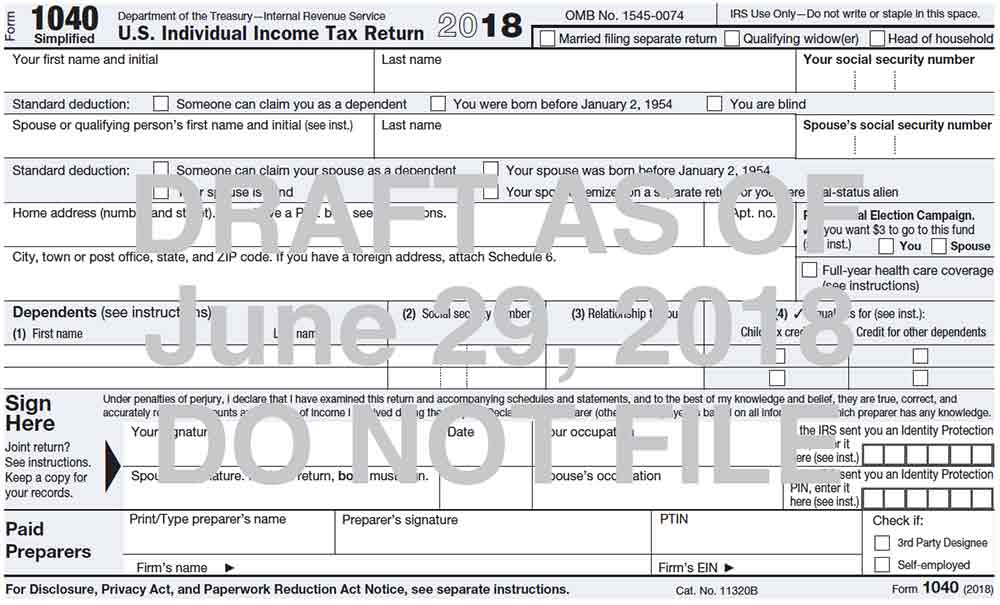

4 Midyear Tax Planning Moves to Make Now

A lot of businesses and individuals wait until December to start thinking about tax planning. While there are definitely some year-end moves you can make that will help to minimize your taxes, now — with the summer quickly coming to an end — is the best time for tax planning. Why now? Halfway through the […]