Using Your 401(k) for Business Funding—Is It Right for You?

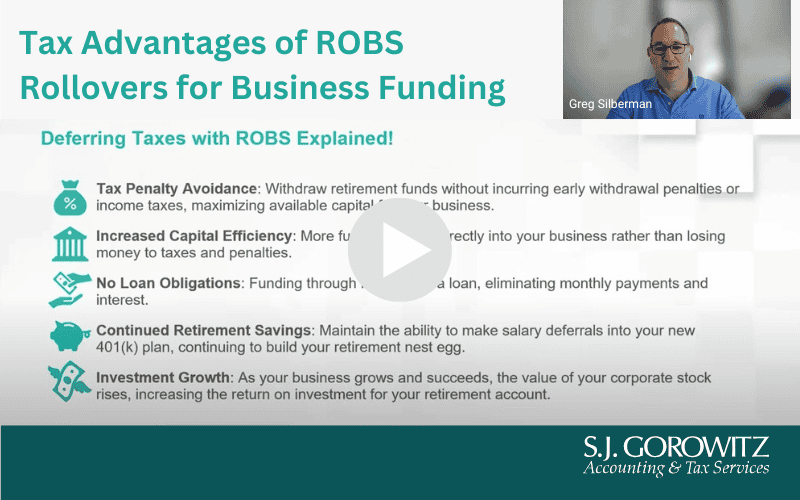

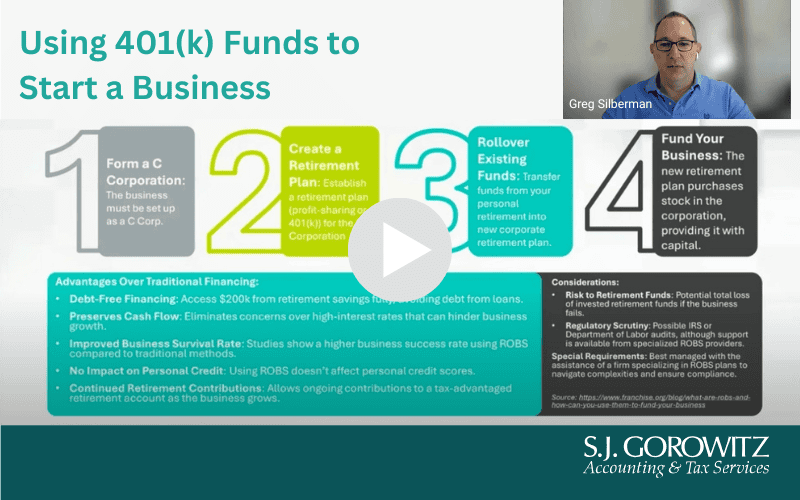

Thinking about using your retirement savings to fund a business? A Rollover as Business Startup (ROBS) allows you to access your 401(k) funds—tax and penalty-free—to invest in your dream venture. It’s a powerful financing option, but it comes with strict IRS rules and potential risks.

What are ROBS?

ROBS stands for Rollovers as Business Start-ups. ROBS are rollovers that utilize your existing 401(k) retirement funds to finance a new or existing business without incurring early withdrawal penalties or income taxes.

If you’ve been contributing to a 401(k) for many years, you’ve likely built up capital that’s now sitting in your account. You may be interested in taking advantage of this SMB trend but don’t have the liquid capital outright to buy a business, and you may not want to take on debt. The ROBS mechanism is a way to utilize your 401(k) savings to access the capital you need without incurring early withdrawal penalties.

Advantages of ROBS

Advantages of the ROBS financing method include:

- Debt-free financing. With ROBS, you’re not borrowing money to put as a payment, a down payment or principal payment on a business. ROBS funds are equity you already have that ordinarily can’t be accessed because of the distribution rules of retirement plans.

- Preserved cash flow. Using saved capital eliminates concerns about high interest rates that can hinder business growth.

- Improved business success rates. ROBS may contribute to a business’s success compared with traditional methods of financing. Owners using ROBS are fully vested and perhaps more incentivized to make the business work. In addition, there’s no impact on personal credit.

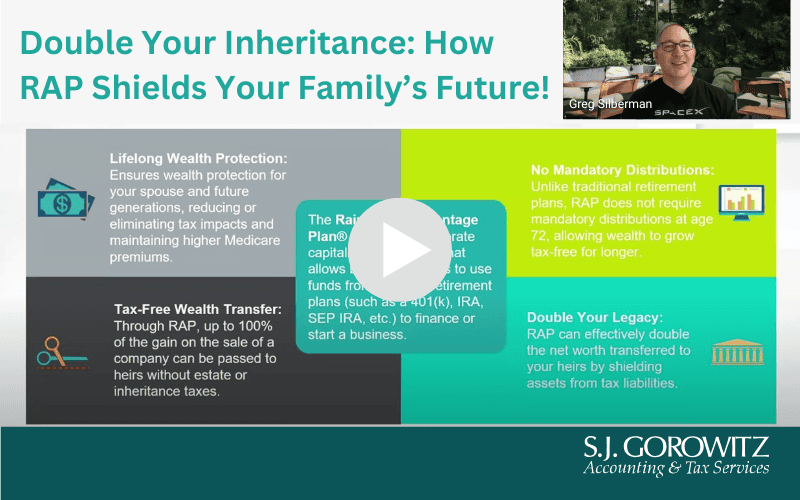

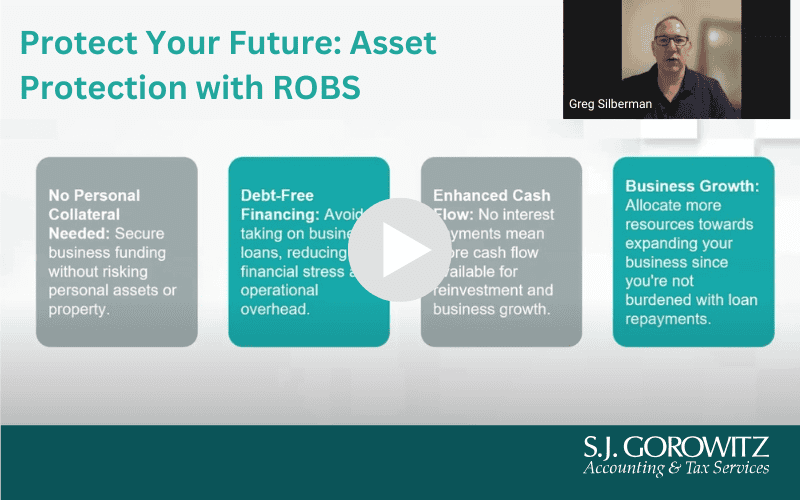

Visit Our ROBS Video Library

Watch these helpful videos to learn more on how ROBS works and how to start the process.

We have professionals at both of our office locations who can assist you!

Alpharetta

- S.J. Gorowitz

- sjgorowitz.com

- 11175 Cicero Drive, Suite 100 Alpharetta, GA 30022

- Phone: 770.740.0797

- Fax 770.740.0197

- info2@SJGorowitz.com

Lawrenceville

- Reed, Quinn & McClure

- rqmcpa.com

- 2055 N Brown Rd, Suite 150, Lawrenceville, GA 30043

- Phone: 770.449.9144

- Fax 770.449.9201

- gsilberman@rqmcpa.com