Artificial Intelligence (AI) is the latest buzz word on everyone’s lips, fast transforming nearly every industry, with accounting being no exception. With the rise of AI-powered tools, the pace of innovation is reshaping how CPAs serve their clients. But here’s what hasn’t changed: the need for human insight, trusted relationships, and ethical judgment.

At SJ Gorowitz, we’re embracing the power of AI; not to replace what we do, but to enhance how we do it. Here’s what you need to know about how AI is changing the accounting profession, and why your relationship with your CPA matters now more than ever.

What AI does well

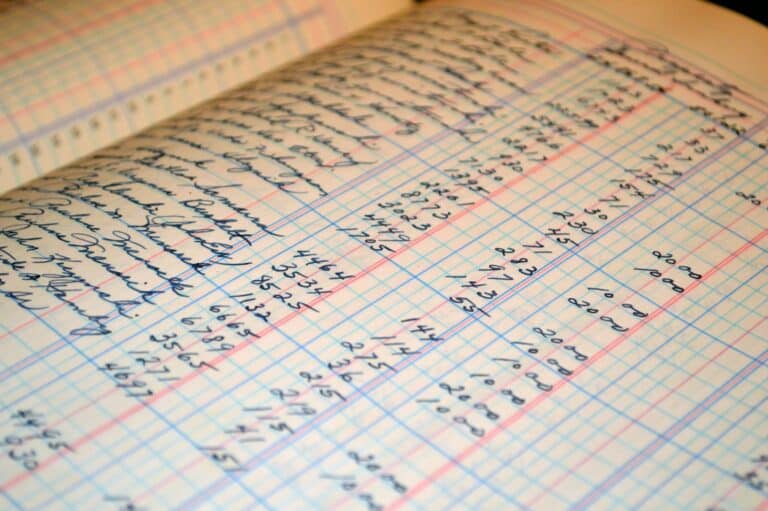

Let’s start with the upside: AI is transforming the accounting profession by enhancing speed, automation, and accuracy across many routine tasks. Examples include:

- Automated bookkeeping and transaction categorization

- Faster financial reporting and dashboarding

- Predictive tools for modeling cash flow and tax scenarios

- Real-time error detection and flagging of anomalies

At SJ Gorowitz, we explore AI tools with caution and compliance in mind and we never input sensitive client data into public AI platforms. Rather, these technologies help us reduce time spent on manual work, so we can focus more on planning, strategy, and proactive guidance.

What AI can’t replace

As powerful as AI is, there are areas where it falls short, and this is where having a CPA remains essential:

- Judgment in complex situations

AI can process data, but it can’t weigh emotional, legal, and strategic considerations. At SJ Gorowitz, our team will guide you through any grey areas, whether it’s evaluating risk, navigating a tax controversy, or planning for succession.

- Trust-based relationships

Financial decisions aren’t just numbers – they’re personal. Clients need an advisor they trust to understand their goals, context, and values, something that our team prides itself on.

- Ethical decision-making

AI lacks a moral compass. Our team at SJ Gorowitz will apply both regulatory knowledge and ethical standards to ensure decisions aren’t just legal, but also right.

- Legacy and purpose

No algorithm can understand what your wealth means to your family, your business, or your long-term goals. Human advisors help you align your financial strategy with your legacy.

The evolving role of the CPA

With AI helping streamline certain administrative tasks, we are able to spend more time focusing on planning, insight, and strategic advice. We are evolving into:

- Strategic partners for growing businesses

- Advisors for wealth alignment and legacy planning

- Educators helping clients understand what the numbers mean

- Ethical guides in an increasingly automated world

At SJ Gorowitz, we use AI to work faster, but never to cut corners. We combine the best of technology with the clarity, judgment, and partnership that only a human advisor can offer.

AI may be a powerful tool, but it will never be a substitute for wisdom, foresight, or human relationships. It may be able organize the numbers, but it’s your CPA who helps make sense of them.

If you’re looking for a firm that uses technology to serve you better, without losing that personal touch, we’d love to talk.

Contact us to learn how we can support your next financial step.