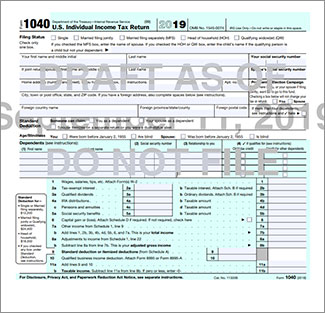

When the IRS announced that it is again changing the 1040 Form, just six months after the release of the much talked about 1040 Form for 2018, my team and I celebrated!

When the IRS announced that it is again changing the 1040 Form, just six months after the release of the much talked about 1040 Form for 2018, my team and I celebrated!

The #1 most important takeaway is that the IRS recognized that the “postcard” sized format was not at all user-friendly and frustrating to all professionals and taxpayers, so the 1040 Form for 2019 returns the income reported from various forms and schedules to the front page.

The IRS has issued draft versions of the 2019 Form 1040 and the schedules that accompany that form. Notably, the six schedules that existed in 2018 are now just three schedules in the 2019 drafts.

So, what else has changed? Here’s how the current and draft forms are alike and how they differ:

- Signatures. The spaces for signatures have moved to page two. This was an issue with the revised Form 1040 in 2018 as many tax preparers didn’t love having a full page of figures without a signature, fearing it could lead to fraud or other problems.

- Since health care coverage is no longer mandatory for the 2019 tax year, that checkbox has been removed.

- Schedule D (Capital Gains) is once again on the income reconciliation schedule (it disappeared in 2018).

- Standard deduction. Standard deduction amounts have moved back to page one.

• Qualified business deduction. The qualified business deduction still has a spot on page one with a note to attach Form 8995 or Form 8995-A. - Tax credits. Separate lines for certain credits, like the Earned Income Credit (EIC) and the additional child tax credit, have been returned to the form. The 2018 version of Form 1040 consolidated the spaces for several tax credits into a line or two, and that proved to be confusing for taxpayers.

- Third Party Designee. The space that previously allowed you to designate another person to discuss this return with the IRS is back on page two. It had been moved to Schedule 6 on the 2018 Form.

S.J. Gorowitz Accounting & Tax Services is always available to assist you with your tax planning and preparation needs. Contact us at any time for more information and assistance.