Between 2013 and 2014, business owners and wage-earning employees saw almost no increases in allowable contribution and elective deferral limitations. Tax year 2014 was characterized by increased tax rates, increased wage limits for social security tax and numerous other indexed items. These limitations effectively took more out of tax payers take home pay, and did not increase the amount someone could save for retirement, tax deferred.

We’re due for some good news, and it has arrived. Uncle Sam is helping us keep a little more of our earnings.

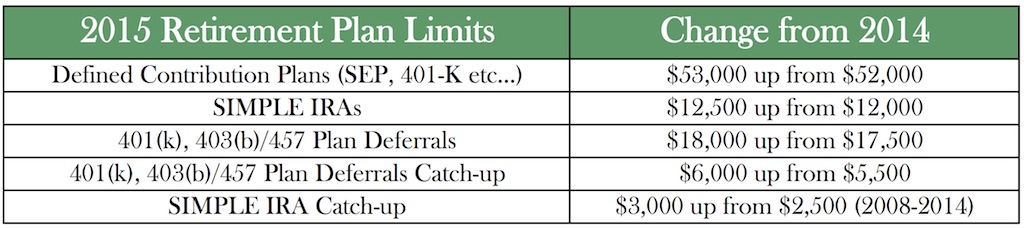

In October, the Internal Revenue Service announced cost‑of‑living adjustments for tax year 2015. These changes impact the dollar limitations for pension plans and other retirement plan contributions. The change comes as a result of the cost-of-living index, which met statutory thresholds, triggering the adjustment.

Some limitations will remain unchanged because the increase in the index did not meet the statutory thresholds that trigger their adjustment. Nonetheless, this is welcome news for all taxpayers, including business owners and the self-employed, who are trying to save for retirement and reduce tax liability.

For a complete listing of contribution limits see the recent IRA news release outlining all changes and impact highlights.

It comes down to this. If you have a retirement plan, whether it is a 401(k), SEP-IRA or a SIMPLE, now’s the time to bump up your allowable pension contributions to maximize their long-term value.

Not sure how to make the most of these new allowances? Contact us for a personalized assessment and plan.

Stacey Gorowitz, CPA, MBA, is founding principal at SJG, where she leads a team that supports the accounting and business advisory needs of expanding and emerging businesses. Stacey is a client advocate and trusted advisor, dedicated to turning numbers into opportunities.