Now that we have gotten settled into 2017, it’s time to get ready to prepare for tax filing season.

The American Institute of Certified Public Accountants (AICPA) for years has advocated for more logical and sensible due dates for income tax returns. As a result, new due dates will go into effect for the 2016 tax and calendar years (2017 filing season) enabling taxpayers and practitioners to have timely and accurate information necessary from flow-through entities’ Schedules K-1s.

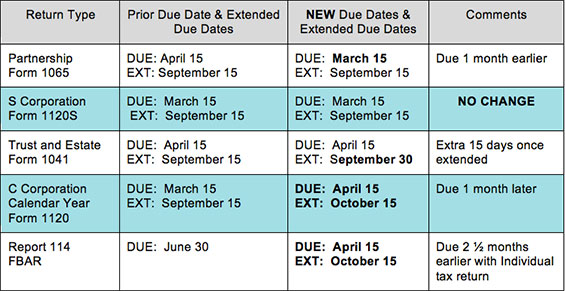

- Partnerships and S Corporations will now have initial due dates of March 15, which will allow for the timely receipt of K-1’s needed by individuals, trusts and C Corporations to complete income tax returns.

- C Corporations will benefit from getting an extra month to file making their initial due date April 15, previously due March 15.

The new due date structure is expected to make the tax return preparation process go smoother and more efficiently. It’s a win for everyone.

The New Due Dates: Effective for 2017 Filing Season

Below is a list of the significant federal due dates generally applicable for 2016 tax returns (2017 filing season) and beyond.

Note: The individual tax return due date of April 15 and extended due date, October 15 have not changed.

We’re tax specialists focused on the accounting needs of emerging businesses. You won’t find a more well equipped or helpful guide. Contact us anytime, and subscribe to our blog for more information that can help keep you safe and compliant.