For companies seeking to grow, shrink, adapt or change their business, or improve their competitive position, a mergers and acquisitions (M&A) strategy often is a natural and potentially viable pursuit.

M&A deals are performed to combine or transfer company ownership, operating units or assets. In simplest terms, a merger combines two companies to form a new company, and an acquisition is the purchase of one company by another in which no new company is formed.[1]

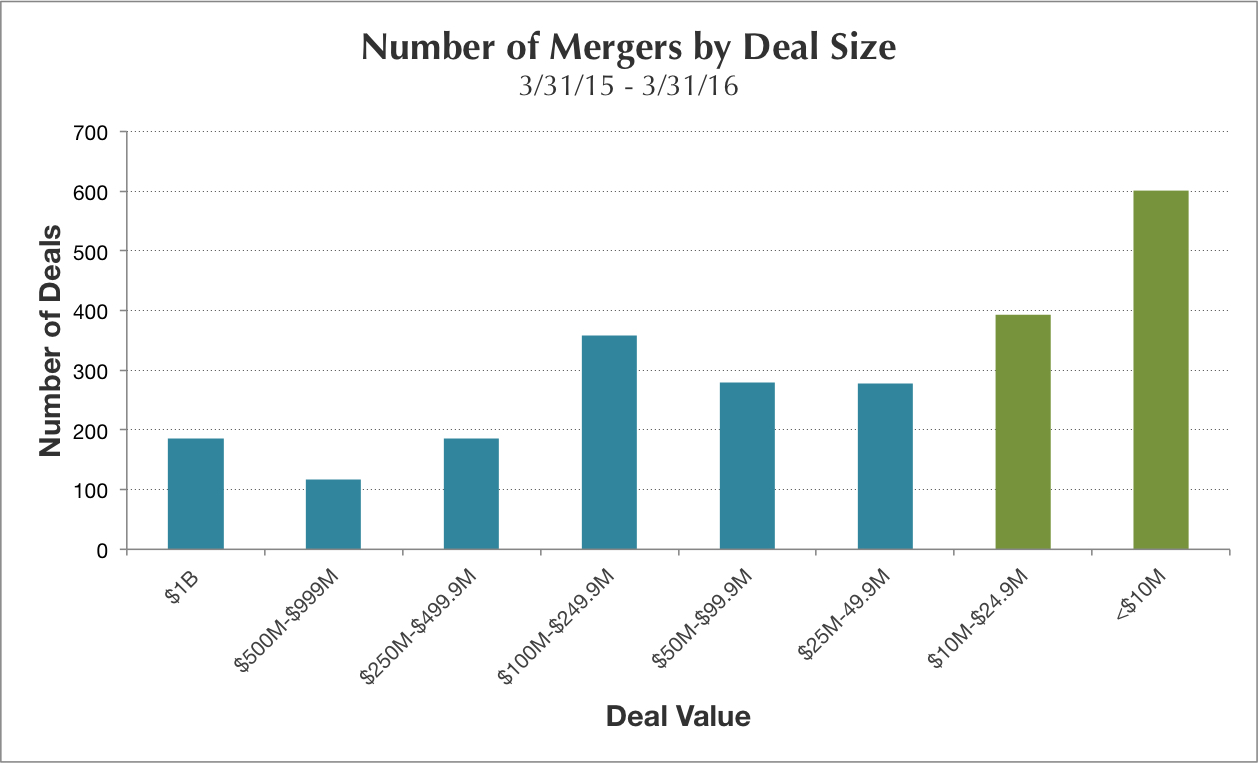

These transactions happen all the time. In fact, FY 2015 saw 12,846 deals, with a cumulative value of $2,194.7B in the U.S. alone.[2] Despite the validity of this approach and the number of deals that are successfully completed, 60% of business owners who try to sell their business fail to get the deal done.[3]

Reasons for High M&A Abandonment Rates

While many reasons exist for the high M&A abandonment rate, decades of experience assisting expanding and emerging companies have shown us that the most common reason is a lack of preparedness. Before even considering an M&A transaction, companies should have a clearly defined strategic plan and airtight financials. And that means making sure your books are – and remain – in order.

We can’t stress enough the importance of maintaining current and historical financial data, including tax returns, balance sheets, and P&L statements. Accuracy and diligence are the only way to keep a holistic sense of your financial strength, which is imperative if you’re planning to position your company to purchase another business, be acquired by another business, or merge assets or operations with another business.

M&A Requirements from the Buy and Sell Side

If you’re planning to acquire a company, you likely will need to secure a commercial loan or a line of credit. That requires you to present proof of your financial condition. If you’re on the other side of the deal, you should expect that any potential buyer will want to review every aspect of your business. Gaps in your records are cause for questions that can reduce the sales price, negatively affect terms, generate excessive professional fees or, worst-case scenario, keep the sale from a successful completion.

Accurate, professionally prepared and presented financial records help increase the confidence of decision makers, which in turn helps to maximize the value of the deal. In fact, post-merger or post-acquisition financials can be even more important – from compliance to setting growth objectives, the accuracy of the books is at the heart of the long-term success of the deal.

Certainly, the size of a deal brings with it unique challenges, opportunities, and requirements. But whether a deal value is less than $10M (the majority of deals by count) or exceeds $100M, the basic imperative is the same. You must embark on an M&A strategy with fully prepared current and historical financial data.

As part of our M&A Advisory Services, we work closely with other M&A experts including business brokers, valuation experts, attorneys, commercial lenders, and investors to help our clients identify and capture opportunities at each step along the transaction process. As part of that, we put a heavy focus on the tasks and strategies specific to M&A transactions, including:

- Buy Side Due Diligence Procedures-Seek to verify reported income, expenses and EBIDTA

- Pre- and post-transaction advisory services

- Deal Structuring

- Identify and fill in any record-keeping gaps

- Income tax planning and entity structuring

- Post-acquisition financial and tax support services

For the 40% of companies that successfully complete an M&A transaction, chances are there is a solid financial advisor helping to keep every detail in place. Our team at SJG has the resources and experience to keep you informed, stable and equipped to meet growth opportunities, whether you are integrating, selling or acquiring a business.

[1]Mergers And Acquisitions (M&A) Definition, Investopedia

[2] US MergerMetrics, FactSet, April 2016

[3] Inc.com