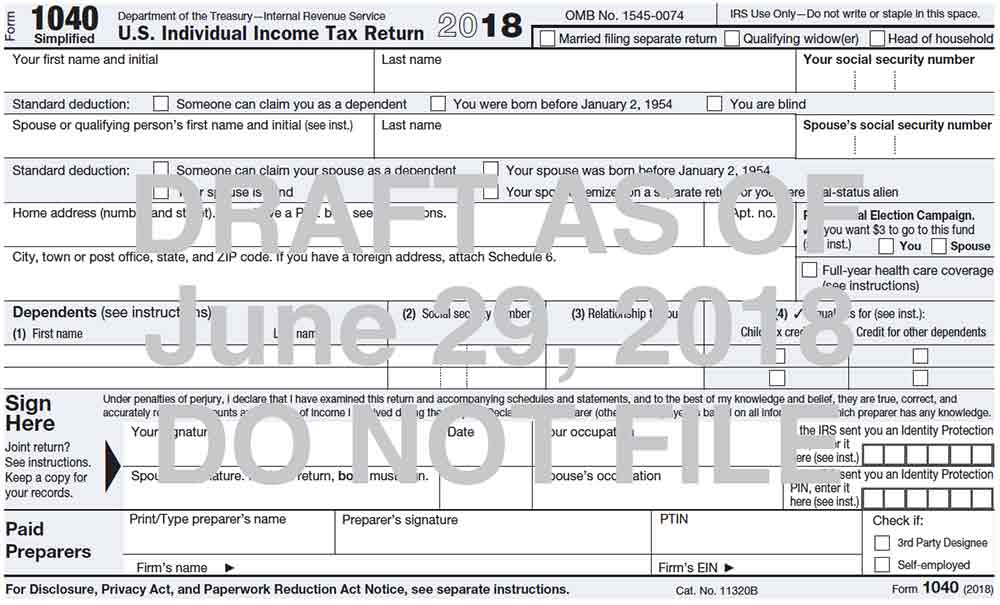

While still in “draft” form, the much-awaited new Form 1040 is finally here. Beginning with the tax year 2018, the new Form 1040 will replace the old Forms 1040, 1040-A and 1040-EZ.

For the most part, taxpayers will report words on the front and numbers on the back. The new front page includes almost no financial information and the signature section has been moved from the back to the front page.

While the main Form 1040 is smaller, filling up both sides of one-half of a standard 8.5”x11” piece of paper, there are six additional schedules that many taxpayers will need to complete and attach:

- Schedule 1-Additional Income and Adjustments to Income

- Schedule 2-Tax

- Schedule 3-Nonrefundable Credits

- Schedule 4-Other Taxes

- Schedule 5-Other Payments and Refundable Credits

- Schedule 6-Foreign Address and Third Party Designee

The Treasury Department estimates that 65% of filers will need to complete at least Schedule 1, for example.

The new tax law helped to eliminate several lines where data is collected by eliminating deductions, such as moving expenses and personal exemptions, and added a new line for the deduction for qualified business income, line 9, which is the deduction for income earned by pass-through businesses.

There are only 23 numbered lines on the new form, in contrast to 79 lines on the older version.

While this will certainly make filing simpler for many individual taxpayers, this will not ease the burden for middle and higher income individuals with tax, expense and income complexities.

This is still very much a work in progress since only the draft form has been released and the instructions have yet to be made public. At SJG we expect to continue to hear much from the IRS and the American Institute of CPAs about the evolution of this form and will share detailed instructions with our valued clientele about how to proceed once we draw nearer the 2018 tax filing season.