Many people have dreams of starting a business but lack the capital or funding needed to launch their new business ideas.

It’s true: It costs money to start a business. The US Small Business Administration (SBA) says that how to fund a business is one of the first — and most important — decisions business owners must make. Self-funding is one way that entrepreneurs leverage their own financial resources to get a business off the ground and tapping into a 401(k) is one option that many entrepreneurs aren’t aware of.

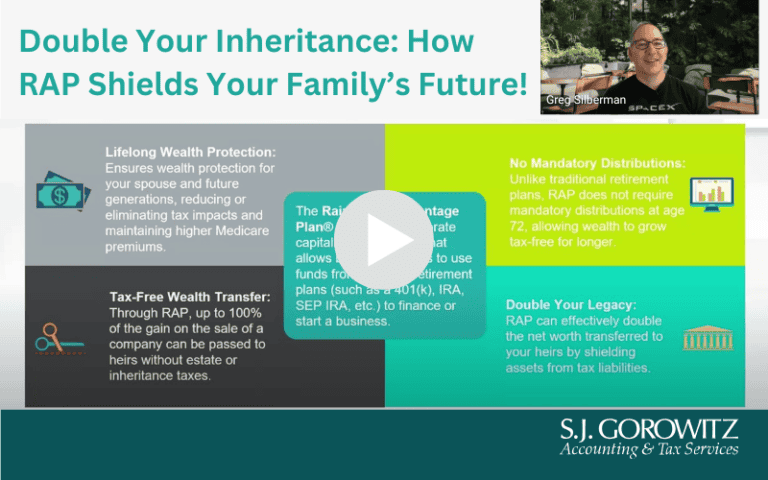

Using Retirement Savings to Fund a Business

When thinking about using retirement funds to start a business, it’s important to note that the options are not limited to borrowing against a 401(k) or taking out a loan from it.

A provision known as Rollover as Business Start-up (ROBS) allows prospective business owners to use their retirement funds to pay for new business start-up costs. An individual would roll over his or her existing retirement funds to a ROBS plan in a tax-free transaction, which then uses the rollover assets to purchase the stock of a new C Corporation business.

According to Benetrends, a financial services firm specializing in connecting entrepreneurs with franchise funding, the ROBS option typically follows these steps:

- The entrepreneur establishes a new C Corporation.

- The C Corporation opens a new 401(k) plan that includes an option for investing in “qualifying employer securities.”

- Funds are rolled over or transferred from the entrepreneur’s retirement plan to the new 401(k) plan.

- The C Corporation’s stock can then be purchased at fair market value, and the sale of the stock generates the business capital needed.

What You Should Know about ROBS

ROBS arrangements can be a highly beneficial source of capital; however, the Internal Revenue Service is strict when it comes to ROBS compliance.

Here are some important points to remember about ROBS:

- Only C Corporations can be used to set up a ROBS. You cannot use LLCs, sole proprietorships or any other types of entities.

- A ROBS arrangement does not borrow against your old 401(k). The new 401(k) established by the C Corporation is investing money in your business in the same way it would invest in any other companies’ stocks.

- Funds from ROBs are tax– and penalty-free, and there’s no limit to the amount of funds you can use from your old 401(k).

- ROBS arrangements may be funded from a variety of plan types, including 401(k)s, IRAs, 457(b)s, 403(b)s, PSPs and SEP IRAs. However, Roth IRAs are ineligible.

If you’re looking to explore your options for startup capital, you need an experienced tax adviser in your corner who is knowledgeable about retirement plans and financing. From proper entity selection at the inception of a business to developing an exit strategy, S.J. Gorowitz Accounting & Tax Services combines the broad experience of a large CPA firm with strong competencies in business advisory and M&A advisory services to meet the needs of emerging and expanding companies. To discuss your needs and situation, please contact us at 770.740.0797 or info2@SJGorowitz.com.