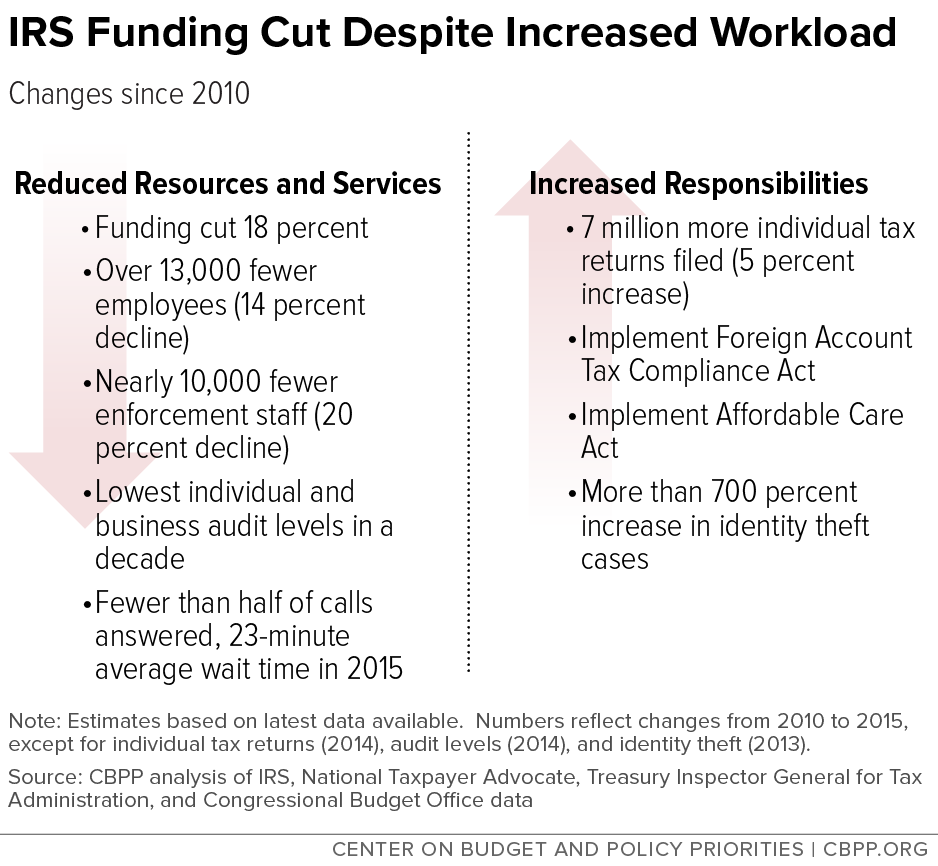

Policymakers have continued to cut the budget of the IRS despite repeated warnings from sources like the IRS Commissioner, National Taxpayer Advocate, Treasury Inspector General for Tax Administration. At this point, the ability of the IRS to carry out its mission has been severely diluted, and US taxpayers are feeling the results.

What do the IRS Budget Cuts Mean for Me?

Overworked, Under-Resourced Workforce

The IRS has reduced its workforce by about 14% since 2010 through a combination of attrition and a hiring freeze. Field offices have been closed, and those that remain are significantly under-staffed. Additionally, the training budget was slashed by 83% between 2010 and 2014, meaning that IRS employees are not only overworked, they are insufficiently prepared to answer questions, prevent issues like tax avoidance, protect taxpayer rights, and relieve unwarranted taxpayer burdens.

Taxpayer Services Have Worsened

Not surprisingly, the quality of taxpayer services has decreased. More than 60% of calls were never answered during the 2014 tax season, no calls are answered outside of tax season, and the number of calls dropped due to an overloaded IRS switchboard rose 16%.

Enforcement Is Weaker

With 20% less staff enlisted to enforce tax laws, the IRS is conducting fewer audits, particularly of high-income taxpayers and businesses. Not only is this causing a decrease in enforcement revenue, it’s expected that it will further elevate the international tax gap – ultimately damaging the budget and potentially increasing deficits.

Fewer Information Technology Upgrades

The IRS needs state-of-the-art information technology (IT) to perform its core functions. Without sufficient regular upgrades, processes like collecting taxes, enforcing tax laws, countering identity thieves and tax evaders, and addressing privacy concerns can’t happen with any degree of reliability. The lag in hardware and software upgrades is compromising the stability of information systems and putting the system at risk of failure and breach, despite reports that the IRS is prioritizing the growing identity theft issue.

Greater Requirements on an Already Taxed System

Beyond just getting the IRS back on track to serve taxpayers at pre-2010 levels, the agency is facing new and mounting responsibilities. From identity theft to issues of tax evasion caused by increasing globalization, to processing massive amounts of data related to the “employer mandate” imposed under the Affordable Care Act, the issues are gaining in number and complexity.

Despite a proposed Presidential “program integrity” budget increase for 2016, funding is expected to remain a real issue for the IRS. With insufficient resources, the IRS is not able to effectively carry out one of the most fundamental tasks of the US government. For you as a taxpayer and business owner, it’s more important than ever to have an informed advisor on your side.

You can download the entire Center on Budgetary Policy and Priorities IRS Funding report here. If you have any questions, please Contact us anytime.