By Candace S. Spencer, CPA

Let’s break down the What, the Who and Why the IRS will penalize you if you don’t file 1099s.

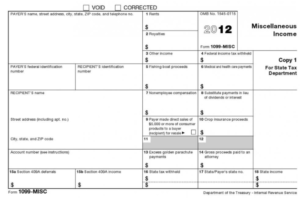

What do you need to know about 1099s in a nutshell? The general rule states that if you are engaged in a trade or business you are REQUIRED to file 1099s. So if Owner, President, CEO, Entrepreneur is on your business card, you are responsible for 1099 filings. The only exception to this rule is if the expenses were paid via credit card. We recommend that before engaging in business with new vendors, you ask them to complete Form W-9, which can be found on the Internal Revenue Service (IRS) website at www.irs.gov. They should fill this out and return it to you before payments are rendered. Actually, the rules state that you’re required to get this form from them before making a payment. Otherwise, you as the business owner are required to do Backup Withholding (an entirely different topic)

What do you need to know about 1099s in a nutshell? The general rule states that if you are engaged in a trade or business you are REQUIRED to file 1099s. So if Owner, President, CEO, Entrepreneur is on your business card, you are responsible for 1099 filings. The only exception to this rule is if the expenses were paid via credit card. We recommend that before engaging in business with new vendors, you ask them to complete Form W-9, which can be found on the Internal Revenue Service (IRS) website at www.irs.gov. They should fill this out and return it to you before payments are rendered. Actually, the rules state that you’re required to get this form from them before making a payment. Otherwise, you as the business owner are required to do Backup Withholding (an entirely different topic)

Who gets a 1099? All individuals and partnerships including certain corporations to whom you’ve paid $600 or more during the year must receive a 1099. Royalties paid of $10 or more are also included in this requirement. Individuals would include nonemployees, like day laborers or subcontractors. Corporations subject to 1099 reporting are those in the medical, health care, legal or fishing activities field. Attorneys to whom you paid legal fees must also receive a 1099. Some of the more commonly overlooked areas in the 1099 reporting are rental payments for office space, as well as equipment and machinery.

The 1099s to the vendors are due by January 31 and the form to the IRS is due by February 28. Remember, this is a requirement for businesses. If you do any of the above as an individual, not a business, you aren’t required to issue a 1099.

Why issue 1099s? The payments made to vendors are a tax-deduction to your business. By issuing 1099s you not only verify your expenses but also help the IRS track who received the income and match that to their income tax returns.

Although this is not a new law, it has flown under the radar for a long time. However, things have changed. As new revenue streams are being identified, 1099 filing requirements are being heavily enforced by the IRS. In fact, it is now what the IRS considers a “High Risk Tax Audit Area – Unreported Taxable Income.”

And of course, there are penalties for failure to file the 1099s as well as failure to furnish these forms to the recipients of the payments. Although most penalties are around $30 – $100 per return, a business can be charged a maximum penalty of $1,500,000 ($500,000 for small businesses).

The 1099 rules can get a little hairy, so business owners can benefit from a tool to help them sort out the requirements. The IRS Advisory Council, of which Cecily Welch, Senior Tax Manager at S.J. Gorowitz Accounting & Tax Services is a member, has recommended a flowchart for business owners that clarifies 1099 regulations. You can find the recommendation at here.

If you can’t figure out the 1099 rules yourself, consider hiring an accountant or CPA. Of course, we’ve over simplified the rules here to keep it user friendly, but the moral of this story should be clear: It’s better to pay the cost of filing 1099s than the IRS’ penalties.