1099 forms can be perplexing, but small business owners neglect them at great risk and cost. If you made a payment during 2015, you may be required to file. And as of 2015, not doing so, doing so late, or doing so incorrectly will cost you the most significant penalties ever experienced.

1099 forms can be perplexing, but small business owners neglect them at great risk and cost. If you made a payment during 2015, you may be required to file. And as of 2015, not doing so, doing so late, or doing so incorrectly will cost you the most significant penalties ever experienced.

What is the 1099

The 1099 Form is a record of payments made from businesses to vendors during the year. Issuing a 1099 verifies your expenses and helps the IRS keep track of who received income and from whom, allowing the IRS to confirm income received by businesses and assure that taxes are being paid on this income.

Who needs to be issued a 1099

You should include all vendors to whom you’ve paid $600.00 or more during the year that are not incorporated. Your list likely includes individuals, partnerships, and some corporate entities, including:

- Contractors

- Non-employees

- Rental payments for office space, equipment, or machinery

- Royalties paid in the amount of $10 or more

Attorneys should be issued 1099’s, regardless of whether the attorney/firm is incorporated or unincorporated.

The smartest way to make sure you have all the information you need to submit your 1099 is to have outside vendors or contractors fill out Form W-9 before ever starting work.

Deadlines for 1099 submittals

The IRS firmly sets the following deadlines:

- 1099’s to vendors are due by January 31

- The form to the IRS is due by February 28

Penalties for missing the 1099 deadlines have increased substantially

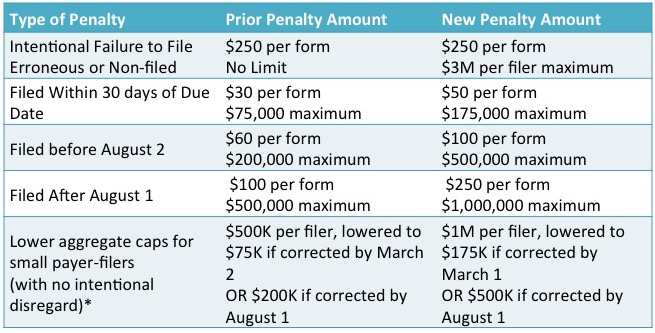

For the second time in five years, Congress has doubled (and in some cases, tripled) the minimum penalties for erroneous or unfiled information returns including 1099 Forms, as well as on W-2 Forms and 1098 Forms. These new requirements can mean hundreds of thousands of dollars in penalties if not followed to the letter.

Additionally, if the proper information return is not filed with the IRS and also is not furnished to the payee, the penalties in the tables below are doubled!

For example, if a business fails to file a Form 1099 and fails to furnish it to the payee but does so within 30 days the penalty would be $50+ $50 = $100/per 1099 Form not filed.

Under the same scenario, If they fail to file until after August 1, the penalty would be $250+$250= $500/per 1099 Form not filed.

Understanding the new 1099 penalty structure

The new penalties have an effectively retroactive application, as they will apply to information returns filed for all payments in 2015. The following chart should help you understand potential penalties for failing to file information returns. If you have any questions, it’s absolutely vital that you consult with a reliable tax advisor sooner than later.

**Applicable to “Small Businesses” which is a business with average annual gross receipts of under $5M during the three years before the reporting year.

We know that filing can be complex and confusing. With penalties increasing at an astounding rate, it’s not worth it to guess at or ignore your responsibilities. If only to reduce your worry factor, make sure you have a reliable accounting partner who can help you file with absolute accuracy.

We’re tax specialists focused on the accounting needs of emerging businesses. You won’t find a more well equipped or helpful guide. Contact us anytime, and subscribe to our blog for more information that can help keep you safe and compliant.