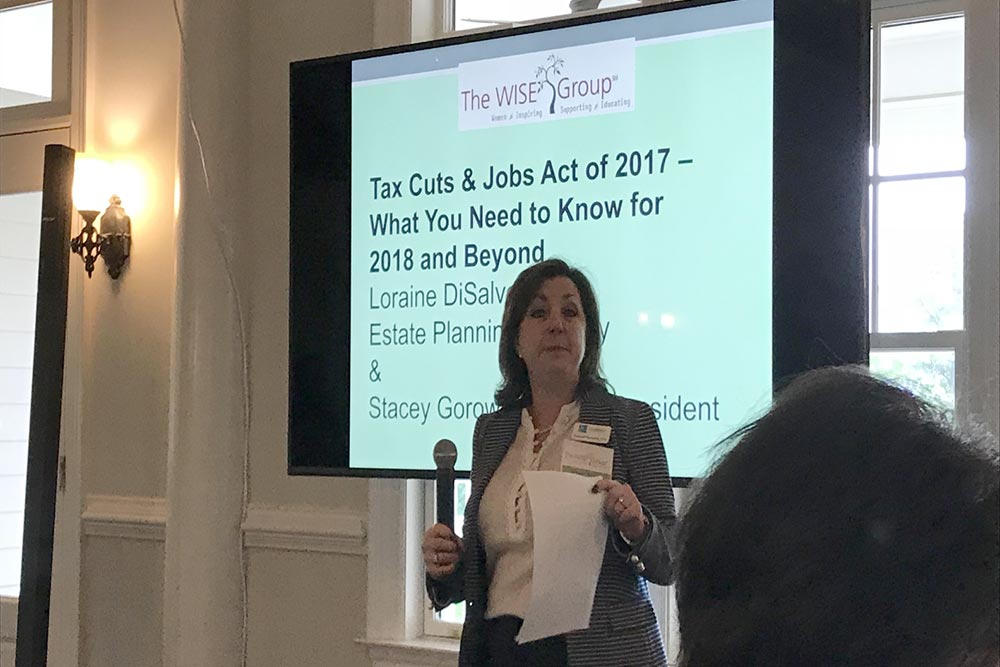

Stacey J. Gorowitz, CPA, MBA, Teams Up with Loraine M. DiSalvo of Morgan and DiSalvo, P.C., at Annual WISE Event

On Thursday, May 17, 2018, the powerful duo of Stacey J. Gorowitz, CPA, MBA and attorney Loraine M. DiSalvo joined forces to speak on the “Tax Cuts and Jobs Act of 2017: What You Need to Know for 2018 and Beyond” at the Lincoln Financial Group’s WISE (Women Inspiring, Supporting and Educating) event at Chastain […]