SJG Blog

Why philanthropy starts with good accounting

Philanthropy isn’t just about giving. It’s about giving wisely. Whether you’re supporting a community cause or establishing a family foundation, meaningful philanthropy begins with clear, ...

Read More → The hidden costs of financial audit surprises: why a proactive review pays

Audit readiness isn’t just about avoiding surprises. It’s about ensuring your financial statements and internal controls are in order before a financial statement audit, not ...

Read More → Entity structures for purpose-driven businesses

The right entity structure doesn’t just determine how you’re taxed. It shapes how capital flows, how profits are distributed, how much liability you carry, and ...

Read More → What to Do When Your Finances Are Under the Microscope

When you run a business, or even manage complex personal finances, there will be times when your financials are put under the microscope. Whether it’s ...

Read More → 90 days to tax readiness: Your Q4 strategy for lowering liability and maximizing savings

As the final quarter of the year begins, many business owners and individuals start thinking about year-end taxes. But waiting until the last minute often ...

Read More → The Power of Tithing: Building Wealth Through Giving

In the first two posts of our charitable giving series, we explored why giving isn’t just generous but rather strategic, and how tithing works as ...

Read More → Featured Posts

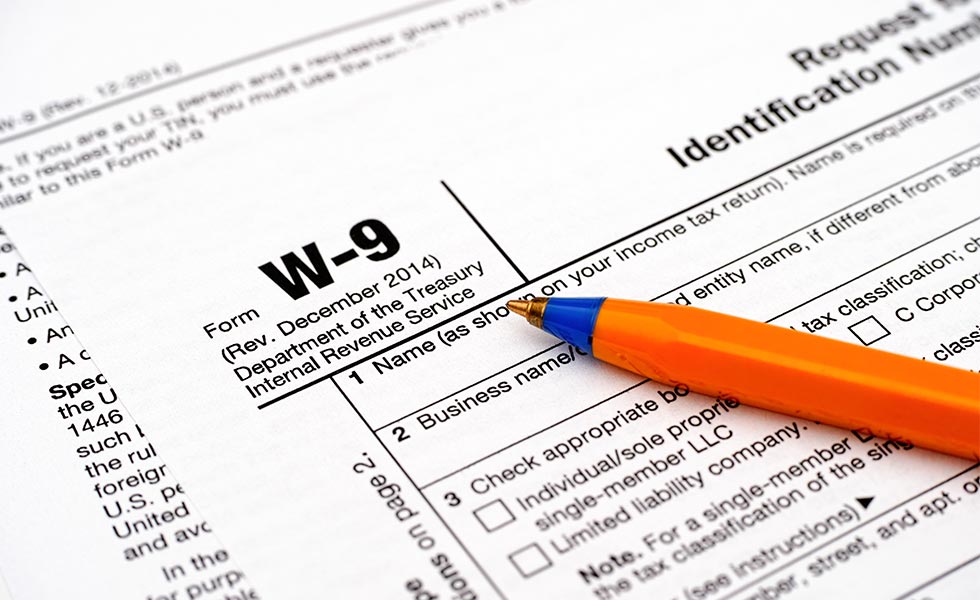

IRS Form W-9 Best Practices

December 16, 2019

As Part I of our 2019 Forms W-9 and 1099-MISC Series, this article explains the purpose of Form W-9. Purpose of Form W-9 An individual ...

Read More → Which Business Financial Records Should I Keep? And For How Long?

September 8, 2021

All businesses, whether large or small, produce an array of records. Maintaining and retaining these records is more than a matter of keeping items in ...

Read More → Tax Strategy and Tax Credits, with Greg Silberman, S.J. Gorowitz Accounting & Tax Services

August 30, 2023

Greg Silberman with S.J. Gorowitz Accounting & Tax Services - Featured Interview on Radio X

Read More →