SJG Blog 2018

IRS Standard Mileage Rates for 2019

Each year, the Internal Revenue Service (IRS) sets standard mileage rates for business based on an annual study of fixed and variable costs of operating an automobile, including depreciation, insurance, repairs, tires, maintenance, gas and oil.

2018 Best of North Atlanta – CPA Award!

Thank you to our clients and colleagues for nominating us for the 2018 Best of North Atlanta – CPA award!

Maintaining CPA Licensure Requires More Effort Than Nearly Every Other Profession

As CPAs, we are considered trusted advisors to our clients and leaned on for expertise that spans many disciplines. Seemingly never-ending changes in tax legislation as well as technology drive the need for regular training and education across a multitude of topics in addition to the learning hours required by

A Recap of the 2018 Southeastern Accounting Show (SEAS)

Just last week Stacey joined her peers at the Southeast’s Premier Annual CPE (Continued Professional Education) Event Sponsored by the GSCPA. The event consisted of two full days and six educational tracks with courses spanning: Keynote-Economic Update Accounting & Auditing – Public Accounting Accounting & Auditing – Industry Business &

4 Midyear Tax Planning Moves to Make Now

A lot of businesses and individuals wait until December to start thinking about tax planning. While there are definitely some year-end moves you can make that will help to minimize your taxes, now — with the summer quickly coming to an end — is the best time for tax planning.

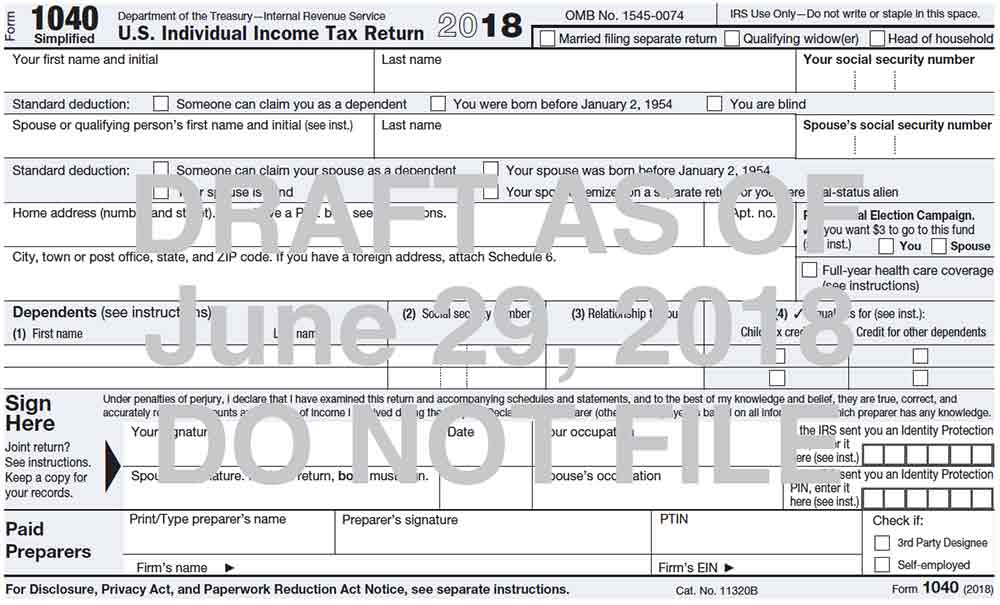

The IRS Has Released the New 1040 Tax Form

While still in “draft” form, the much-awaited new Form 1040 is finally here. Beginning with the tax year 2018, the new Form 1040 will replace the old Forms 1040, 1040-A and 1040-EZ. For the most part, taxpayers will report words on the front and numbers on the back. The new