SJG Blog

Charitable Giving: A smart strategy for taxes, legacy, and impact

When clients come to us at S.J. Gorowitz with questions about how to save on taxes, build wealth, or create a financial legacy, they’re often ...

Read More → How to align your finances with your values: a mid-year check-in

As we reach the halfway point of the year, many business owners have their heads down busy navigating cash flow, meeting payroll, or preparing for ...

Read More → Tax Planning: Align your Finances with Purpose

Why do the wealthy rarely dread tax season? Because they don’t wait until April. They plan for taxes ahead — with purpose. Whether you’re a ...

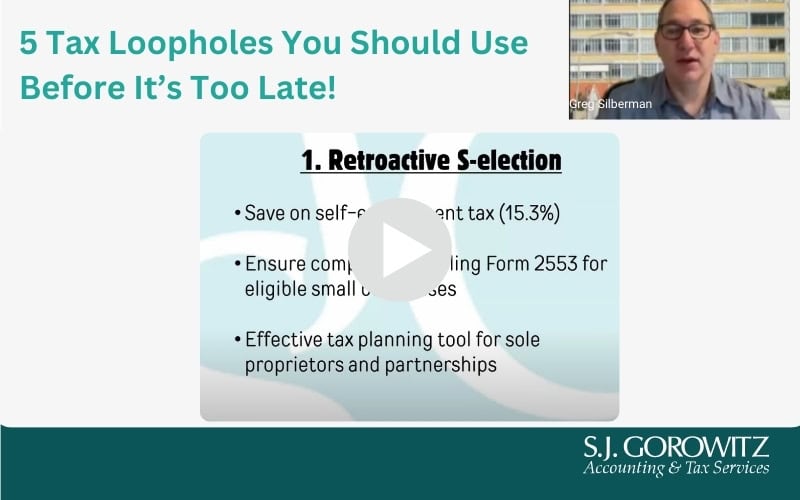

Read More → Five Tax Loopholes Before It’s Too Late. Number 1 is S Corp Election.

We are beginning a blog series on five tax loopholes to consider using before it’s too late. These strategies are worthwhile to keep in mind ...

Read More → What Trump Means for Taxes

A question on the minds of many Americans is, “What does Trump intend to do about taxes?” now that he has taken office. With the ...

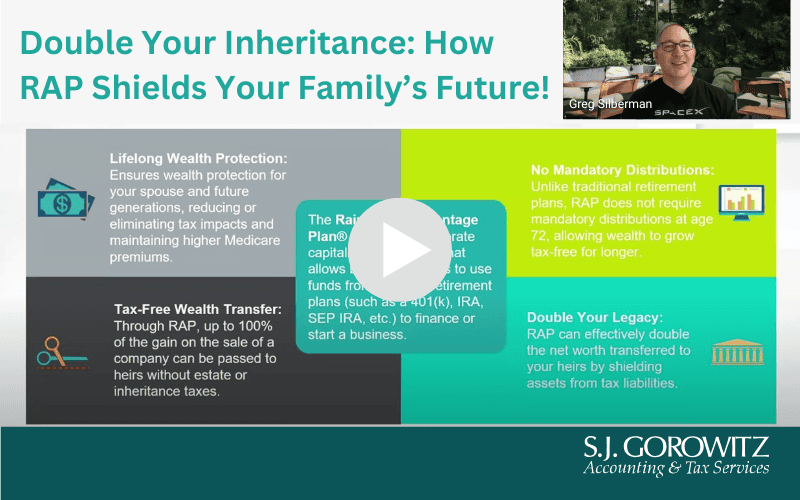

Read More → Wealth Preservation Using a ROBS Financing Strategy

We’re seeing a significant demographic shift shaking up the small and middle-sized business (SMB) market. As Baby Boomers are aging and retiring, many are looking ...

Read More → Featured Posts

IRS Form W-9 Best Practices

December 16, 2019

As Part I of our 2019 Forms W-9 and 1099-MISC Series, this article explains the purpose of Form W-9. Purpose of Form W-9 An individual ...

Read More → Which Business Financial Records Should I Keep? And For How Long?

September 8, 2021

All businesses, whether large or small, produce an array of records. Maintaining and retaining these records is more than a matter of keeping items in ...

Read More → Tax Strategy and Tax Credits, with Greg Silberman, S.J. Gorowitz Accounting & Tax Services

August 30, 2023

Greg Silberman with S.J. Gorowitz Accounting & Tax Services - Featured Interview on Radio X

Read More →